The iron and steel industry has become one of the main beneficiaries of global economic recovery. The sharp rise in iron ore prices coincides with growing demand for steel as economies begin to recover from the COVID-19 crisis. The vertically integrated Severstal and NLMK should benefit most in this scenario. Both companies are in close geographic proximity to important export markets. Investors may also consider Evraz and MMK as an attractive investment. However, MMK is dependent on external suppliers for raw materials making them more attractive only after prices for iron ore begin to decline.

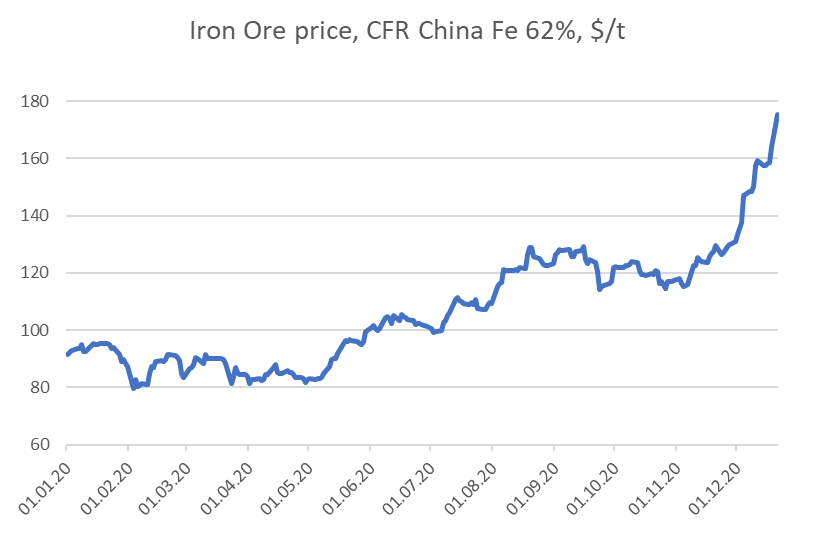

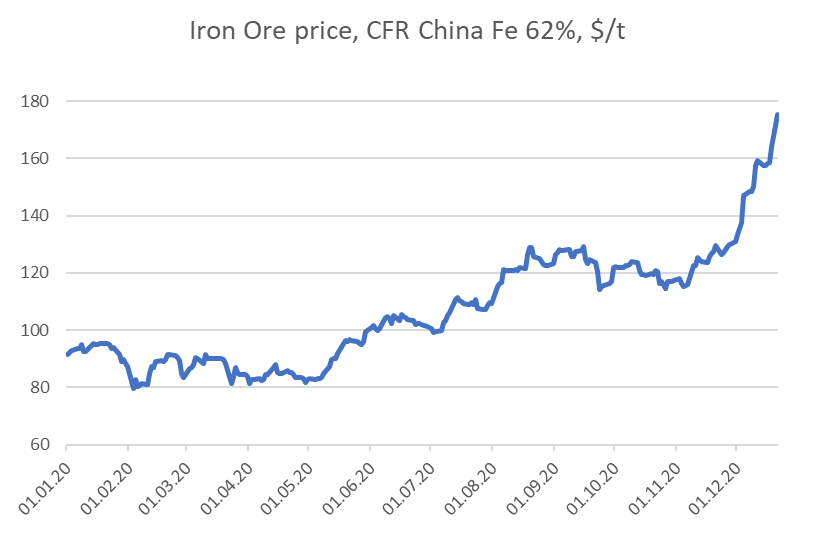

Iron ore prices keep climbing

On Monday, December 12th iron ore prices rose 7.8% reaching $176.9/t – their highest since 2011 due to robust demand in China and concerns about supply from Brazil. Rainy season in Australia overlapped with news of a fatal landslide at Vale mine in Brazil last week. Brazil is the world's second largest exporter of iron ore after Australia. Operations at Vale’s mine have been suspended for seven days.

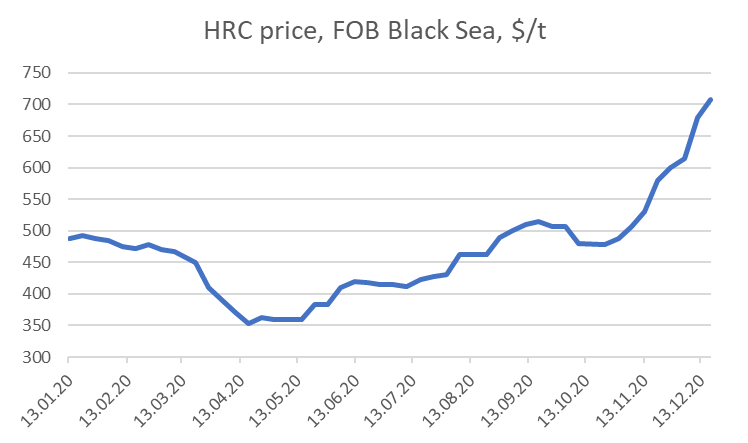

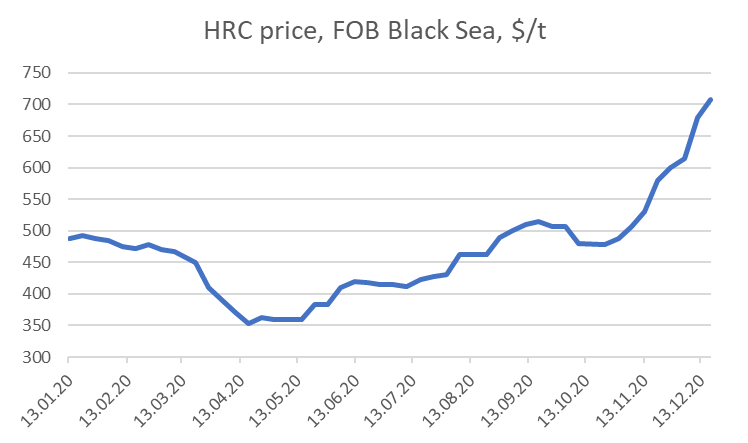

Record high steel products prices

Russian hot-rolled coil export prices (HRC, FOB Black Sea) hit nine-year high of over $660/t. The spike in steel prices has been supported by robust demand in China (steel output grew by 13% YoY in October), low stock levels due to expectations of second-wave lockdowns, the production hiatus for steelmakers in Europe due to the pandemic, as well as low interest rates for mortgages and construction aimed at stimulating development. Large-scale infrastructure project launches are becoming an incentive for stimulating the economy not only in China, but also in India and developed countries, which increases the demand for steel.

Severstal CEO Alexander Shevelev recently informed RBC that he expects steel prices to continue rising and then to balance out towards the end of 1Q21 when the deferred demand of 2020 will be met.

Advantageous positioning of vertically integrated NLMK and Severstal

Vertical Integration makes NLMK and Severstal more resilient to fluctuations in the raw material market than competitors, which becomes very relevant when iron ore prices are peaking. Both companies completed a series of investment projects aimed at reducing the consumption of third-party raw materials.

NLMK has significant iron ore reserves and consequently a high degree of vertical integration and will be the main beneficiary of the spike in raw material prices.

Severstal stands out among its peers in the global metals industry as the most efficient (highest EBITDA margin in the industry and the lowest cost of sales in Russia). The company has modernized production assets and is almost entirely self-reliant.

Export operations can be expanded

Both companies have advantageous locations of resources, they are close to export and raw material markets, which makes it possible to redirect supplies between the domestic and foreign markets relatively quickly. This is particularly significant given the volatility of the ruble exchange rate. About 70-80% of the steelmaker’s costs are nominated in rubles, which adds a margin of safety when the ruble is weak.

Severstal has the lowest anti-dumping duty on products imported into the EU amongst Russian steelmakers allowing for an increase in the percent of export sales. Severstal's management noted that the company will use up to half of its utilized capacity to manufacture products for export. In case of a decrease in demand for metal products in Russia the opportunity to increase exports may be especially important.

The introduction of the EU carbon tax could be another means of protectionism. However, the process has been decelerated amid the global crisis, in our opinion. Carbon-free steel-making technologies have yet to prove their economic feasibility at this stage of development.

Support from the Russian market

Steel consumption in Russia will be about 5.7% lower than in 2019, according to Severstal estimates. The construction industry (main steel consumer) has recovered, although at the beginning of the pandemic there was concern about the suspension of construction projects in Moscow and the Moscow region.

Recovering energy prices are enabling oil and gas companies to boost investments. In this context, Severstal's management forecast for a recovery in demand for large diameter pipes looks positive (published by Interfax on December 21).

Demand for large diameter pipes (LDP)

Expectations of recovery in demand for LDP in Russia ... According to Severstal, demand in Russia for large-diameter pipes in 2020 fell by 29% YoY to 1.375 million tons. Recovery of the LDP market is expected in the next few years due to investment projects planned by Gazprom, Rosneft, Transneft’s oil pipeline modernization. In 2021 consumption volumes may increase by 13.5% to 1.56 million tons, by 2022 this figure will reach 2.517 million tons (+61%), in 2023 - 2.525 million tons (+0.3%). In 2024 a retracement of demand is expected to the level of 2.14 million tons.

... in Europe ... According to the company's forecasts demand in the European region this year will decrease by 56% YoY amounting to 350 thousand tons. A recovery is expected in 2021, demand of LDP will reach 400 thousand tons, 500 thousand tons in 2022, 550 thousand tons in 2023 and 600 thousand tons in 2024.

... in MENA countries Demand in the region sank by 24% totaling 1.56 million tons. In 2021 an increase of 15% is expected with demand reaching 1.8 million tons, in 2022 – another increase of 11%, in 2023 and 2024 demand may amount to 2.2 million tons.

This week Severstal reported a drop in large-diameter pipe (LDP) shipments by 34% YoY amounting to 230-240 kt of shipments in 2020 (including 30 kt of exports to Europe vs 17 kt in 2019). The capacities of the Izhora Pipe Mill in 2020 were often loaded by 50% -70%. As a reminder, the mill produces 610-1420 mm diameter pipes, with a width of up to 40 mm to and a length of 18 m. In 2021 the company plans to run production at 100% capacity and produce 400 thousand tons of LDP. In 2020 Severstal received an order from Gazprom for 320 thousand tons of LDP (almost 100 billion rubles).

Investing in iron ore production after the increase of the MET

The increase of the MET in 2021 will negatively affect investment programs and financial results. The company is now seeking amendments to the law to protect projects in development. There is a possibility of arranging agreements protecting investments and exempting projects where production is growing by more than 10% per year from the new tax rate.

More specifically, this concerns Severstal’s projects Vorkutaugol, Yakovlevsky mining and processing plant (an investment of 27 billion rubles to increase the volume of iron ore production from 800 thousand to 5 million tons in 2023), Olenegorsk plant and Karelsky Okatysh.